The state Department of Revenue beat its own deadline by a day and is saying

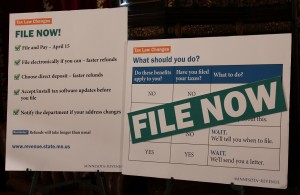

“File Now!” After a brief update, its processing systems now are ready for all taxpayers.

The tax-collecting agency had advised many Minnesotans against filing state returns until April 3 because of a slew of retroactive changes to tax laws made by the Minnesota Legislature on March 21. An estimated 300,000 taxpayers are affected by new “middle class” tax breaks, effective for 2013 returns.

State tax forms now have been revised;, state computer systems have been updated; and tax preparation software from private companies have been certified, Revenue officials said just after noon on Tuesday (4/2).

What should you or your tax preparer be doing now?

- · If you’ve already filed, relax. The Department of Revenue automatically will adjust your return for the new tax cuts, issue refunds due and explain the changes in a letter. If DOR needs more information OR if you have to amend your return, you’ll get a request in letter mail (not email).

- · If you’ve waited to file, you or your tax preparer should go ahead and file as normal. Everything’s ready to process your return. One reminder: If you’re using tax preparation software, don’t forget to load the latest Minnesota updates to your computer.

The big deadline remains unchanged. State tax returns are due by the end of the day on April 15, unless an extension is requested. About 1 million of a total 2.6 million Minnesota taxpayers have yet to file.

Revenue officials did note one fall-out affecting taxpayers: “Refunds will take longer than usual.”

Tax pros such as EricJohn Ltd. have been kept in the know by Revenue and should be ready to answer most technical questions. Both individuals and businesses also might want to plan ahead for other changes effective from 2014 forward.