It is property tax payback time for many homeowners and renters in Minnesota. Better yet, taxpayers who are eligible for refunds are going to find the state government is more generous than last year. Property tax rebates are up 3 percent for homeowners and 6 percent for renters this year.

It also winds up that more Minnesota taxpayers can qualify for the refunds, which are set on a sliding scale based on income levels and tax/rent payments. So, if you didn’t qualify last year, maybe this is the year!

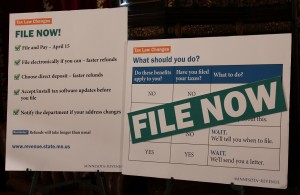

There’s still more plenty of time to apply. Both homeowners and renters can request refunds on Form M1PR through Aug. 15, the official deadline.

Qualifying homeowners will get their refund based on local government (city, county, township, etc.) property taxes payable in 2014; technically it’s called the “homestead credit refund.” The maximum refund is $2,657.

Renters claim their property tax refunds based on rent they paid in 2013. The max rebate is $2,120.

Minnesota Revenue last week announced a complication for taxpayers who filed for refunds early. If your household income was changed by the middle class tax cuts and you applied for a property tax refund before April 2, you’ll need to amend that M1PR to reap a full refund.

The correct household income is the important issue here. If you filed the M1PR from April 2 forward and used the new household income, no other action should be necessary. The tax agency will either adjust your property tax refund form (and will send you a letter explaining any changes) or will process them as usual.

Taxpayers who were not affected by the middle class tax cuts also won’t need to take any new action.

EricJohn Ltd. is ready to navigate the property tax refund system for Minnesota taxpayers.