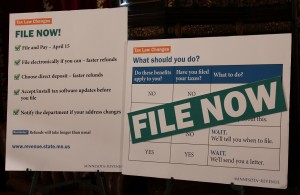

On Monday, taxpayers discovered whether they will or will not benefit from Minnesota’s “middle class tax cuts,” approved by state lawmakers late last week. Minnesota Revenue Commissioner Myron Frans outlined the tax breaks at a news conference. (See http://vimeo.com/89950804. )

It’s clear that hundreds of thousands of taxpayers will benefit from them; it’s also clear that the late date of the changes – within a month of the filing deadline for 2013 returns – is going to complicate some filings and refunds,

April 3 is an important date. That’s when the state Department of Revenue plans to have revised forms and instructions available both for tax preparers, such as EricJohn Ltd., and the general public.

All this is happening to simplify Minnesota’s tax system and coordinate it better with federal tax rules. In short, Minnesota has been taxing some items that are deductible on federal returns. The new state law allows those federal deductions to apply in Minnesota, as well. The DOR lists 10 changesfor 2013 tax returns:

- Expansion of the Working Family Tax Credit – It could add $334 for families declaring between $25,000 and $45,000 a year in their modified adjusted gross income.

- Mortgage insurance deduction – Homeowners now can deduct mortgage insurance premiums. A limit of $110,000 in modified adjusted gross income applies.)

- Mortgage debt forgiveness – If a lender forgave part of a mortgage loan, the homeowner can exclude that amount from Minnesota income.

- Higher education tuition deduction — Many taxpayers who spent for tuition and fees to a college or another postsecondary school be in line for a deduction of as much as $4,000. (Modified AGI limits apply.)

- Student loan interest deduction – Those who paid student loan interest might be able to deduct as much as $2,500 from their Minnesota return. (Modified AGI limits apply.)

- Education savings exclusion – Taxpayers who used a Coverdell savings account to pay education costs can exclude those distributions from Minnesota income.

- Education scholarships – A couple of scholarships related to the National Health Service Corps also can be excluded.

- Educator expense – Teachers or employees in K-12 schools can deduct as much as $250 for books or supplies they purchased for classroom use.

- Assistance from an employer – Workers who receive money from an employer for education, commuting or adoption costs can exclude that assistance on Minnesota returns. (Each type of cost has a limit for the exclusion.)

- Donations from an IRA – Taxpayers who are 70½ or older can exclude as much as $100,000 of their contributions from an IRA to a qualified charity.

Want more details? Navigate by computer to www.revenue.state.mn.us and, on the first page, click the orange button named “Tax Law Changes.”

CLAIMING NEW TAX CUTS

About 1.4 million tax returns – of an estimated 2.7 million coming – already have been filed. Minnesota’s DOR plans to make adjustments to any prevously filed returns with the new tax breaks, using figures from federal tax returns. Taxpayer involved will receive a notice by mail (NOT by email) and a refund. Or, the notice may ask for more information.

If the DOR can’t adjust a return adequately, the taxpayer will have to file an amended return to take advantage of the new tax cuts.

Here is some advice from the Minnesota Revenue. If you qualify for any of the new tax breaks and have not yet sent in your return, wait until after April 3, when revised forms become available. Your return won’t require special handling and processing should be quicker.

Your Minnesota return will be processed if you send it now, but you also may have to wait longer for a refund, especially with an amended return. The state tax agency could take as long as six months to process an amended return, Frans said.

Currently, about 1 in 10 taxpayers, or more than 250,000, are likely to receive a larger refund because of the changes approved in recent days. . Next year, about 1 million Minnesota taxpayers are expected to benefit from those tax breaks, Frans said.